Finding the perfect office space is a major step for any business. But before you move in, you need to navigate a critical document: the office lease agreement.

This legally binding contract outlines the terms and conditions of your tenancy, defining everything from rent payments and lease duration to maintenance duties and permitted use of the space.

A clear, well-structured agreement is your best defense against future disputes and unexpected costs. It protects both you and the landlord by setting clear expectations from day one, ensuring a stable and productive environment for your business to grow.

Getting the details right from the start provides peace of mind and a solid foundation for your operations.

In this guide, we will demystify the office lease agreement, providing essential insights into its key components and common pitfalls. We’ll also offer practical templates to help you draft or review your lease effectively.

Table of Contents

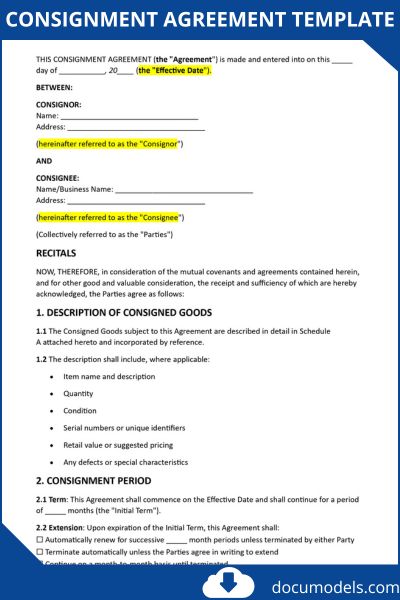

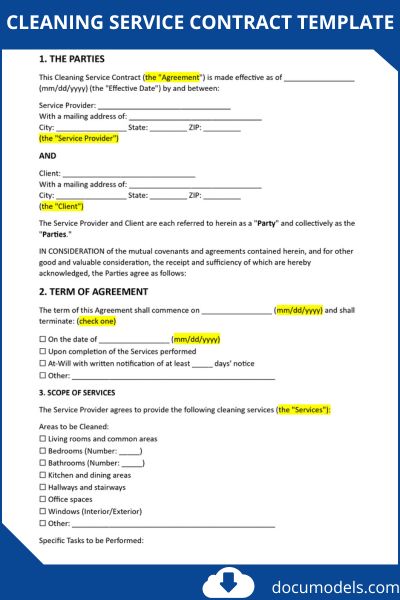

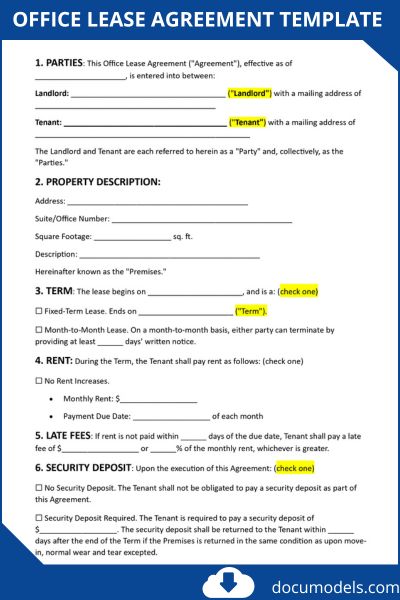

Office lease agreement template

A well-crafted lease not only protects your interests but also sets the foundation for a successful landlord-tenant relationship.

Office lease agreement template (Word)Sample office lease agreement

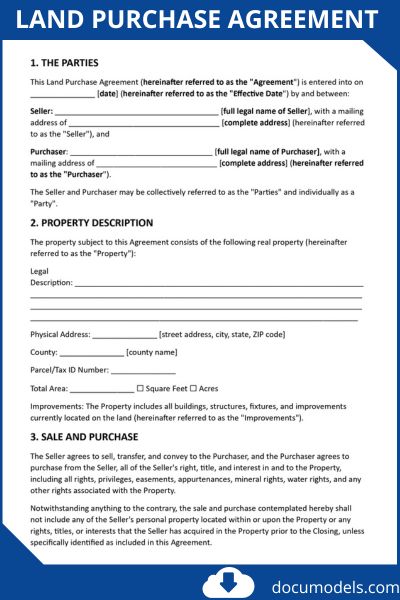

Office-Lease-Agreement-Template-pdfWhat Is an Office Lease Agreement?

An office lease agreement is a legally binding contract between a landlord (the property owner or manager) and a tenant (the business or individual renting the space) that outlines the terms for renting commercial office space.

It’s designed for professional or business use, unlike residential leases which focus on living spaces. These agreements ensure both parties understand their rights, responsibilities, and financial obligations, helping to prevent disputes down the line.

For first-time renters, think of it as a roadmap for your occupancy—detailing everything from rent payments to who fixes the air conditioning. Leases can range from short-term (a few months) to long-term (several years), depending on your business needs.

Key benefits include:

- Stability: Provides a fixed location for your operations.

- Customization: Allows negotiations for improvements or modifications.

- Cost Predictability: Locks in rent rates, often with escalation clauses for future increases.

Types of Office Lease Agreements

Office leases are not one-size-fits-all. The type of lease determines how you pay for rent and other property-related expenses. Understanding the common types will help you evaluate different offers and negotiate a deal that fits your budget.

Full-Service Lease (Gross Lease)

A full-service lease, also known as a gross lease, is the simplest type for tenants. You pay a single, flat monthly rent amount. The landlord is responsible for paying all the property’s operating expenses, including property taxes, insurance, utilities, and maintenance.

- Pros: Predictable monthly costs make budgeting easier. The landlord handles all property management, freeing you to focus on your business.

- Cons: The base rent is typically higher to cover the landlord’s estimated expenses. You may pay for services you don’t use heavily.

Net Lease

In a net lease, the tenant pays a lower base rent plus some or all of the property’s operating expenses. There are several variations of the net lease.

Single Net Lease (N Lease)

The tenant pays the base rent plus a pro-rata share of the property taxes. The landlord covers all other operating expenses. This type of lease is less common.

Double Net Lease (NN Lease)

The tenant pays the base rent plus a pro-rata share of both property taxes and property insurance. The landlord is responsible for structural maintenance and common area utilities.

Triple Net Lease (NNN Lease)

This is one of the most common types of commercial leases. The tenant pays the base rent plus a pro-rata share of all three major operating expenses: property taxes, insurance, and common area maintenance (CAM).

- Pros: Base rent is lower, and you have more transparency into the building’s operating costs. You may benefit from cost savings if the property is managed efficiently.

- Cons: Monthly costs are variable and can fluctuate, making budgeting more challenging. You might face unexpected increases in taxes or maintenance fees.

Modified Gross Lease

A modified gross lease is a hybrid between a full-service and a net lease. The tenant pays a fixed base rent for the first year. In subsequent years, the rent may increase to cover a proportional share of any increases in the building’s operating expenses.

The specifics of what’s included in the base rent and what’s considered an additional expense are negotiated and defined in the lease.

What Should an Office Space Lease Contract Include?

A well-drafted office lease contract should cover all essential details to protect both parties and clarify expectations. For beginners, reviewing these elements ensures nothing is overlooked during negotiations.

Here’s a detailed list of what to include:

Basic Information

- Parties Involved: Full names and contact details of the landlord and tenant (including business entities if applicable).

- Property Description: Exact address, square footage, floor plan, and any included amenities (e.g., parking spaces, conference rooms).

Financial Terms

- Rent Amount and Payment Schedule: Base rent, due dates, payment methods, and any late fees.

- Security Deposit: Amount, conditions for return, and deductions for damages.

- Additional Costs: Breakdown of utilities, taxes, insurance, and common area maintenance (CAM) fees.

- Rent Escalation: Clauses for increases, such as annual percentage hikes or tied to the Consumer Price Index (CPI).

Lease Duration and Renewal

- Term Length: Start and end dates, with options for short-term, long-term, or month-to-month.

- Renewal Options: Rights to extend the lease, notice periods, and any changes in terms.

Use and Maintenance

- Permitted Use: Specifies the space is for office purposes only, with restrictions on activities (e.g., no manufacturing).

- Maintenance Responsibilities: Who handles repairs, HVAC systems, janitorial services, and structural issues.

- Alterations and Improvements: Rules for modifications, who pays, and restoration requirements at lease end.

Insurance and Liability

- Insurance Requirements: Types and amounts of coverage needed (e.g., liability, property damage).

- Indemnification: Clauses protecting one party from claims arising from the other’s actions.

Termination and Defaults

- Early Termination: Conditions for breaking the lease, penalties, and notice requirements.

- Default Provisions: What constitutes a breach (e.g., non-payment) and remedies like eviction or lawsuits.

Other Clauses

- Subleasing/Assignment: Permissions to sublet or transfer the lease.

- Signage and Parking: Rights to exterior signs and allocated parking spots.

- Force Majeure: Protections for unforeseen events like natural disasters.

- Governing Law: Which state’s laws apply and dispute resolution methods (e.g., arbitration).

Note: Always include signatures, dates, and any attachments like exhibits or addendums. For visual clarity, consider attaching a floor plan diagram if negotiating in person.

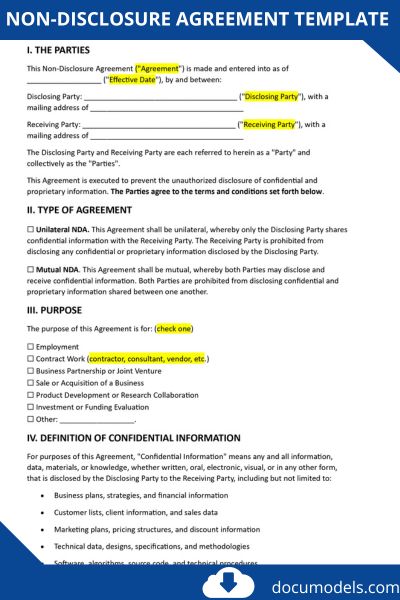

Legal and Compliance Considerations

As a first-timer, focus on compliance with local, state, and federal regulations to ensure the agreement is enforceable and fair.

Zoning and Building Codes

- Verify the space is zoned for commercial office use and complies with building codes, accessibility standards (e.g., ADA in the US), and fire safety regulations.

Environmental and Health Compliance

- Check for environmental hazards like asbestos or lead, and ensure HVAC systems meet air quality standards. Leases should address who handles compliance testing.

Tax and Financial Regulations

- Understand tax implications, such as property taxes shared in net leases. Also, review for compliance with anti-money laundering laws if applicable.

Fair Housing and Discrimination Laws

- While primarily for residential, commercial leases must avoid discriminatory practices in tenant selection or terms.

Dispute Resolution and Governing Law

- Include clauses for mediation or arbitration to resolve conflicts efficiently. Specify the jurisdiction for any legal actions.

Key Risks to Watch For

- Hidden Fees: Scrutinize for unexpected CAM charges or pass-through expenses.

- Personal Guarantees: Small businesses may require owners to personally guarantee the lease, risking personal assets.

- Exit Strategies: Ensure clear terms for lease assignment or subletting if your business grows or relocates.

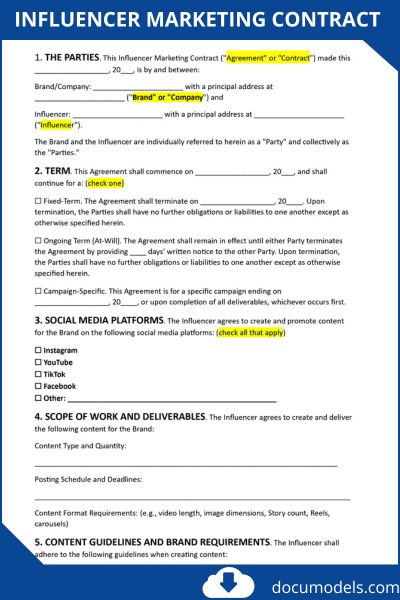

Format model to edit

Related Articles: