Buying land is one of the most significant investments you can make—whether you’re planning to build your dream home, start a business, or expand your real estate portfolio. However, before any money changes hands, it’s essential to have a land purchase agreement in place.

This legally binding document outlines all the critical details of the transaction, including the purchase price, property description, payment terms, contingencies, and closing date.

A well-drafted agreement doesn’t just formalize the sale; it protects both the buyer and the seller from potential disputes and misunderstandings down the line.

Understanding how to structure and customize a land purchase agreement can save you time, money, and stress.

In this guide, we will explore the essential components of a land purchase agreement, including key clauses and legal considerations. Additionally, we’ll provide customizable templates to help you draft your own agreement with confidence.

Table of Contents

- 1 Land purchase contract template

- 2 What Is a Land Purchase Agreement?

- 3 When Do You Use a Land Purchase Contract?

- 4 Types of Land Purchase Agreements

- 5 Essential Elements of a Land Purchase Agreement

- 6 How To Write a Land Contract

- 7 Special Considerations in Land Purchase Agreements

- 8 Frequently Asked Questions (FAQ)

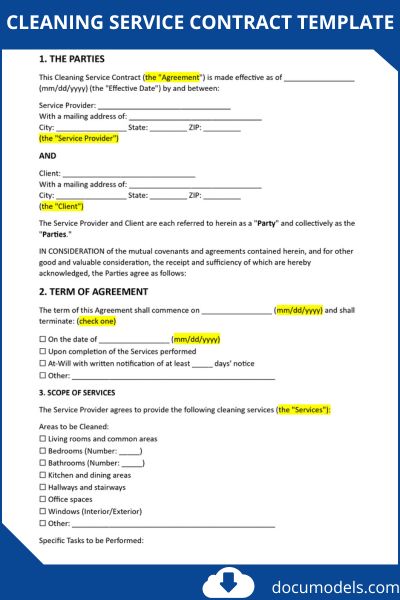

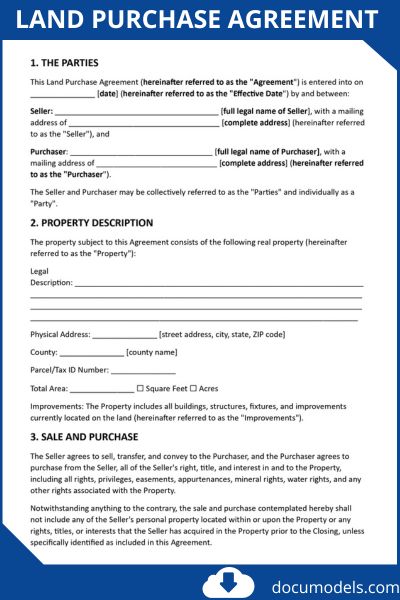

Land purchase contract template

Without a well-drafted agreement, you risk misunderstandings and potential disputes that could derail your investment.

Land purchase agreement (Word)Sample land purchase agreement

Land-Purchase-Agreement-pdfWhat Is a Land Purchase Agreement?

A land purchase agreement, also known as a land contract, is a legally binding document that outlines the terms and conditions of a transaction involving the sale of vacant land. Unlike a home purchase, which includes a structure, this contract deals exclusively with the real property itself—the soil, the boundaries, and any rights that come with it.

This document serves as the roadmap for the transaction. It details the purchase price, financing terms, closing date, and any specific promises or obligations of both the buyer and the seller. Once signed, it creates a legal obligation for both parties to follow through with the sale according to the agreed-upon terms.

When Do You Use a Land Purchase Contract?

A land purchase contract is necessary anytime you are buying or selling a parcel of land that does not have a significant structure on it. This simple definition covers a wide range of scenarios.

You should use a land purchase contract for:

- Residential Lots: Purchasing an empty plot in a subdivision or a standalone lot to build a custom home.

- Commercial Land: Acquiring land zoned for business purposes, such as building an office, retail space, or industrial facility.

- Agricultural Land: Buying farmland for growing crops, raising livestock, or other agricultural uses.

- Raw or Undeveloped Land: Investing in large tracts of land with no immediate plans for development, often for recreational use or long-term appreciation.

- Seller-Financed Deals: In situations where the seller acts as the lender, a land contract is essential for defining the payment schedule, interest rate, and consequences of default.

Types of Land Purchase Agreements

Land purchase agreements come in various forms, depending on the property type, financing, and parties involved. Understanding these can help you choose the right one for your needs.

Below is a table summarizing the main types:

| Type | Description | Best For | Pros | Cons |

| Traditional Land Contract | Buyer makes installment payments directly to the seller, who holds the title until full payment. Often includes interest. | Buyers with poor credit or no bank access. | Flexible payments; builds equity over time. | Risk of forfeiture if payments lapse; higher interest rates. |

| Wrap-Around Land Contract | Seller finances the buyer while still paying their own underlying mortgage. The buyer’s payments cover the seller’s loan plus profit. | Properties with existing mortgages. | Allows sellers to profit without paying off their loan first. | Complex; risk if seller defaults on their mortgage. |

| Standard Purchase Agreement | A straightforward contract for cash or financed sales, outlining terms without installment payments. | Quick, conventional land buys. | Simple and legally binding. | Requires full financing upfront. |

| Lease-Purchase Agreement | Combines a lease with an option to buy; renter pays toward purchase over time. | Test-driving the property before committing. | Builds equity during lease; flexible exit. | Option fee may be non-refundable. |

| Option to Purchase | Gives the buyer the right (but not obligation) to buy at a set price within a timeframe. | Speculative or development land. | Locks in price; low commitment. | Premium paid for the option. |

Essential Elements of a Land Purchase Agreement

A land purchase agreement must be detailed and unambiguous to prevent future disputes. While specific requirements can vary by state, every contract should include these core components.

1. Identification of Parties: The full legal names and addresses of both the buyer and the seller must be clearly stated.

2. Description of the Property: This is more than just the street address. It must include the official legal description of the property, which can be found on the current deed or through the county recorder’s office. This may include lot numbers, block numbers, and metes-and-bounds descriptions.

3. Purchase Price and Payment Terms: The contract must specify the total purchase price. It should also break down the payment structure, including the earnest money deposit, down payment, and how the remaining balance will be paid (e.g., through new financing or seller financing).

4. Contingencies: These are conditions that must be met for the sale to proceed. Common contingencies include:

- Financing Contingency: The buyer must be able to secure a loan.

- Inspection Contingency: The buyer has the right to conduct inspections (e.g., soil tests, environmental assessments) and can back out if the results are unsatisfactory.

- Title Contingency: A title search must show that the seller has a clear and marketable title to the property.

- Zoning/Permitting Contingency: The buyer can cancel the deal if they are unable to obtain the necessary permits for their intended use.

5. Closing Date and Costs: The agreement must set a specific date for the closing, which is when the property officially changes hands. It should also outline who is responsible for paying various closing costs, such as title insurance, escrow fees, and recording fees.

6. Seller Disclosures: The seller is often required by law to disclose any known issues with the property, such as environmental hazards, boundary disputes, or liens.

7. Default and Remedies: What happens if one party breaches, such as forfeiture, penalties, or dispute resolution methods.

8. Signatures and Date: All parties must sign, with witnesses or notarization as required by state law.

How To Write a Land Contract

While it is always recommended to have a real estate attorney draft or review a land purchase agreement, understanding the process is valuable.

Here is a step-by-step guide to writing a basic land contract:

- Start with the Basics: Begin by titling the document “Land Purchase Agreement” and listing the date. Identify the buyer and seller by their full legal names.

- Define the Property: Use the property’s legal description to accurately identify the land being sold. Include the county and state where the land is located.

- Outline the Financials: Clearly state the purchase price. Detail the earnest money deposit amount, the down payment, and the financing arrangement for the balance. If seller-financed, specify the interest rate, payment schedule, and term of the loan.

- Set the Conditions (Contingencies): List all contingencies that apply to the deal. For each one, define what must happen, who is responsible, and the deadline for meeting the condition. Also, state the consequences if a contingency is not met.

- Specify Closing Details: Set a firm closing date. Designate an escrow agent or attorney to handle the closing process. Apportion the closing costs between the buyer and seller.

- Include Standard Legal Clauses: Add standard provisions, such as how disputes will be resolved (e.g., mediation or arbitration), what happens if one party defaults, and a statement that the written agreement supersedes all prior oral agreements.

- Create Signature Lines: Include signature blocks for both the buyer and the seller, along with space for the date. In some states, the signatures may need to be notarized.

Special Considerations in Land Purchase Agreements

Beyond the basics, several factors can make or break a deal. These are especially important for beginners to avoid costly mistakes:

- Zoning and Land Use Restrictions: Check if the land can be used as intended (e.g., residential vs. agricultural). Include clauses for rezoning if needed.

- Environmental and Hazard Testing: Contingencies for soil tests, flood zones, or hazardous materials. Vacant land often requires percolation tests for septic systems.

- Financing and Title Issues: Ensure clear title; watch for liens or easements. If seller-financed, specify balloon payments or prepayment penalties.

- Taxes, Insurance, and Maintenance: Decide who pays property taxes, insurance, and upkeep during the contract period.

- Possession and Closing Dates: Clarify when the buyer can take possession—before or after full payment. Include extensions for delays.

- State-Specific Laws: Some states require disclosures for lead paint or radon; others limit interest rates on seller financing.

- Risks for Buyers: Potential forfeiture if payments are missed; limited legal protections compared to mortgages.

Frequently Asked Questions (FAQ)

Ensure the contract accurately reflects the agreed-upon price, includes contingencies like financing and inspections, specifies earnest money terms, and outlines responsibilities for closing costs. Also, verify the property description and included fixtures.

The buyer makes regular payments (usually monthly) to the seller, including interest. In traditional contracts, title transfers after full payment; in wrap-around, the buyer gets the deed upfront while the seller handles any existing mortgage.

Upon default, sellers can often forfeit the contract, reclaim the property, and keep payments as liquidated damages, without full foreclosure processes in many states. Buyers may lose equity built; some states offer redemption rights or require judicial foreclosure. Review the contract’s remedies clause and local laws.

Property back taxes are unpaid taxes from previous owners. Zoning refers to local government regulations that dictate how land can be used (e.g., residential, commercial). Both can affect your ability to develop or use the land as intended.

Yes, once signed, it’s enforceable, creating obligations for both parties. However, state laws differ on requirements like recording; always review with an attorney to ensure validity and protections.

Risks include unclear terms, forfeiture of payments/equity on default, balloon payments, uninhabitable properties, and paying taxes/insurance without title. Eviction is faster than foreclosure, potentially causing total loss.

It’s essential to confirm the availability of utilities like water, electricity, and sewage systems. In rural areas, these may need to be installed at additional cost. Check with local utility providers for specifics.

Format model to edit

Related Articles: