Thinking of selling goods without buying them first? Or maybe you want someone else to sell your products for you? This is where a consignment arrangement shines, and it’s all held together by a crucial document: the consignment agreement.

This legally binding contract outlines the terms between a consignor (the product owner) and a consignee (the seller), detailing responsibilities, commission fees, and the timeframe for the sale.

A well-drafted consignment agreement protects both parties, creating a clear and secure business relationship. It allows consignors to get their products in front of more customers without managing a storefront, while consignees can offer a wider variety of inventory without the upfront cost and risk.

In this guide, we will explore the key components of a consignment agreement, including essential terms and conditions, inventory management, and legal considerations. Additionally, we will provide a customizable template to help you draft your own agreement effectively.

Table of Contents

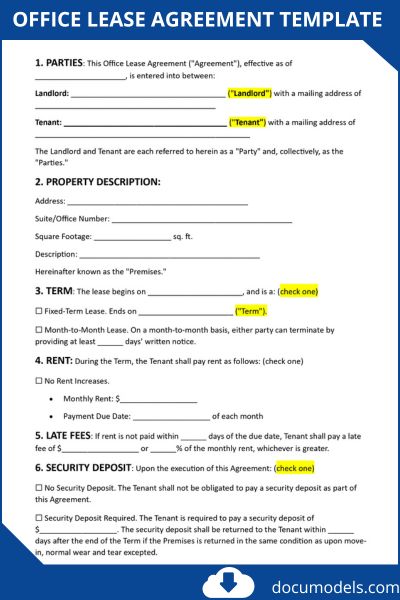

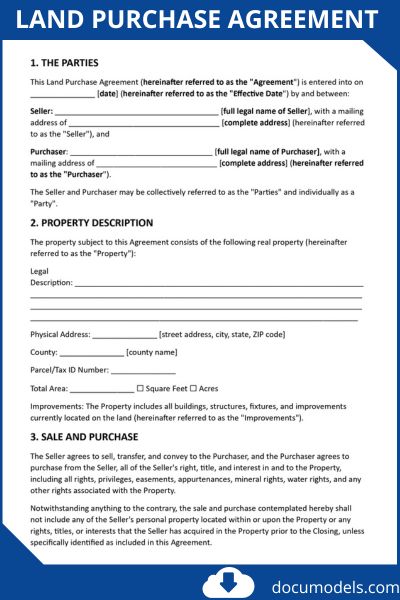

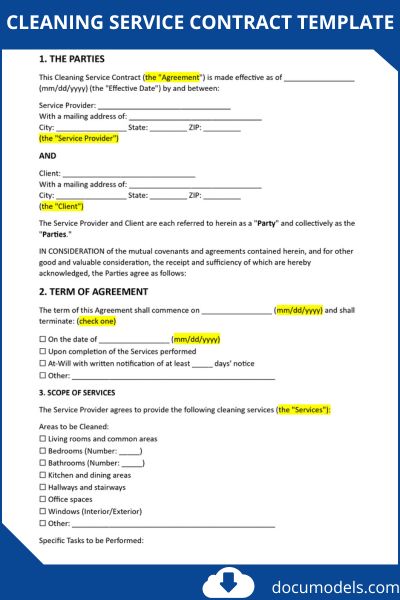

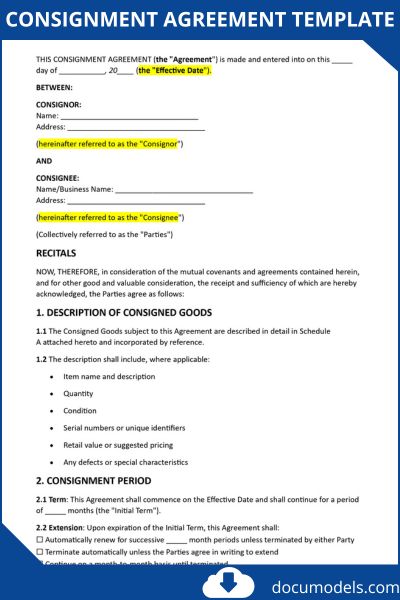

Consignment agreement templates

Understanding the intricacies of a consignment agreement is essential for protecting both parties and ensuring smooth transactions.

Sample consignment agreement (Word)Sample consignment agreement

Consignment-Agreement-Template-pdfWhat Is a Consignment Agreement?

A consignment agreement is a legally binding contract between two parties: the consignor (the owner of the goods, such as a manufacturer or artist) and the consignee (the party responsible for selling the goods, like a retailer or gallery). Under this agreement, the consignor delivers goods to the consignee, who attempts to sell them to customers.

Ownership of the goods remains with the consignor until a sale occurs, at which point the consignee pays the consignor a portion of the proceeds (typically after deducting a commission or fee).

Key characteristics include:

- No upfront payment: The consignee doesn’t buy the goods outright; they only pay if and when the items sell.

- Risk sharing: The consignor retains ownership risk (e.g., damage or loss), but the consignee handles sales and marketing.

- Common in various industries: From clothing boutiques to antique shops, consignment is versatile.

Note: Unlike a standard sales contract, where title transfers immediately, consignment emphasizes a temporary placement for sale. This makes it ideal for testing market demand without full commitment.

When Are Consignment Agreements Used?

Consignment agreements are employed in scenarios where sellers want to minimize financial risk or expand reach without heavy investment.

Here are common use cases:

- Art and Collectibles: Galleries often operate on consignment, allowing them to display and sell art without purchasing it first. This is ideal for both emerging and established artists.

- High-End Fashion and Jewelry: Luxury boutiques and secondhand clothing stores use consignment to offer a curated selection of designer goods. It allows them to carry expensive inventory without a massive capital investment.

- Handmade Crafts and Furniture: Artisans and craftspeople can place their unique creations in local shops or markets, expanding their reach beyond online platforms or craft fairs.

- Seasonal and Trend-Based Goods: For products with a short shelf life, like holiday decorations or fast-fashion items, consignment helps retailers avoid getting stuck with unsold stock.

- Used Vehicles: Car dealerships sometimes sell vehicles on consignment for private owners, taking a commission once the car is sold.

What Should a Consignment Agreement Include?

A well-drafted consignment agreement should cover all essential terms to protect both parties and avoid disputes. Below is a breakdown of key elements, organized for clarity.

Essential Clauses

- Parties Involved: Full names, addresses, and contact details of the consignor and consignee.

- Description of Goods: Detailed list of items, including quantities, conditions, serial numbers, and values (e.g., using photos or appraisals for high-value items).

- Duration: Start and end dates of the consignment period, with options for renewal or termination.

- Pricing and Payment Terms: Sale price guidelines, commission rates (e.g., 40% to consignee), payment schedule (e.g., monthly), and handling of discounts or promotions.

- Delivery and Return: How goods are delivered, inspected upon arrival, and returned if unsold.

- Insurance and Liability: Who insures the goods against loss, theft, or damage? Typically, the consignee assumes responsibility while in possession.

- Sales Reporting: Requirements for the consignee to provide sales reports, inventory updates, and access to records.

- Exclusivity: Whether the consignee has exclusive rights to sell in a certain area or if the consignor can use multiple outlets.

- Termination and Dispute Resolution: Conditions for ending the agreement, notice periods, and methods for resolving conflicts (e.g., mediation or arbitration).

- Governing Law: The jurisdiction’s laws that apply (e.g., state-specific).

How to Make a Consignment Agreement

Creating a consignment agreement doesn’t require legal expertise upfront, but following a step-by-step process ensures it’s tailored and enforceable. Start with a template from reliable sources, then refine it based on your needs. This approach saves time and reduces errors, making the document ready for real-world use.

Here’s a numbered guide to crafting your own:

- Gather Information: Collect details on both parties, the goods, and desired terms. Consult your business goals—e.g., if you’re the consignor, prioritize high commission rates.

- Outline the Structure: Use the table above as a foundation. Draft each section clearly, avoiding jargon. For example, in the payment section: “The consignee shall remit 70% of the net sale price to the consignor within 15 days of each sale.”

- Incorporate Protections: Add clauses for insurance, audits (e.g., allowing the consignor to inspect inventory quarterly), and dispute resolution (like mediation before litigation).

- Review for Clarity and Fairness: Read through for ambiguities. Tip: Involve a neutral third party, like a business advisor, to spot biases—balance is key to long-term partnerships.

- Customize with Examples: Include sample scenarios, such as: “If an item sells for $100, the consignor receives $60, and the consignee keeps $40 after deducting any agreed fees.”

- Get Legal Review: Have an attorney vet the draft, especially for state-specific laws. This step, while adding cost, prevents costly revisions later.

- Sign and Distribute: Execute the agreement in duplicates, and provide copies to both parties. Track compliance from day one.

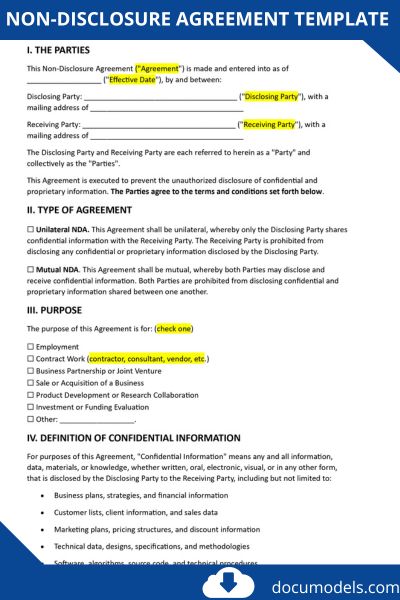

Legal Considerations and Best Practices

While consignment agreements offer flexibility, they come with legal nuances. Always tailor them to your jurisdiction, as laws vary.

Key Legal Considerations

- Ownership and Title: Under US law, the consignor retains title, but file a UCC-1 financing statement if goods exceed $1,000 to protect against consignee bankruptcy.

- Tax Implications: Consignors report income when goods sell; consignees deduct commissions as expenses. Consult a tax advisor.

- Consumer Protection: Ensure compliance with laws like the FTC’s rules on truthful advertising.

- International Deals: For cross-border consignments, address customs, tariffs, and international trade laws.

- Dispute Risks: Common issues include unsold goods, damage claims, or delayed payments—include arbitration clauses to avoid court.

Best Practices

- Build Trust: Start with small consignments to test the relationship.

- Use Technology: Track inventory with apps like QuickBooks or consignment-specific software (e.g., ConsignCloud).

- Regular Audits: Schedule periodic checks to verify stock and sales.

- Seek Professional Advice: For valuables over $5,000, involve an attorney to review.

- Update as Needed: Amend the agreement for changes in terms or laws.

- Avoid Common Pitfalls: Don’t overlook insurance; specify exact commission splits (e.g., 60/40); clarify who handles returns from customers.

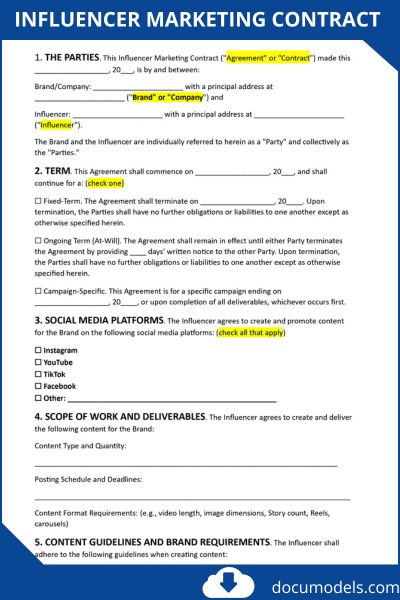

Format model to edit

Related Articles: