Embarking on a new business venture with a partner is an exciting prospect, filled with potential and shared ambition.

However, the foundation of a successful and lasting collaboration is built on clarity, not just enthusiasm. This is where a partnership agreement becomes one of your most critical assets.

Think of it as a detailed roadmap for your business relationship, outlining roles, responsibilities, contributions, profit distribution, and procedures for resolving disputes or dissolving the partnership.

A well-drafted agreement protects every partner’s interests and prevents misunderstandings that could jeopardize the business down the line. It aligns expectations from day one, ensuring that everyone is on the same page about the journey ahead.

If you’re considering a partnership or want to strengthen an existing one, keep reading—you’ll discover practical examples and ready-to-use partnership agreement templates that can help you get started.

Table of Contents

Samples Partnership Agreement

This document outlines the roles, responsibilities, and expectations of each partner, ensuring a clear understanding that can prevent conflicts.

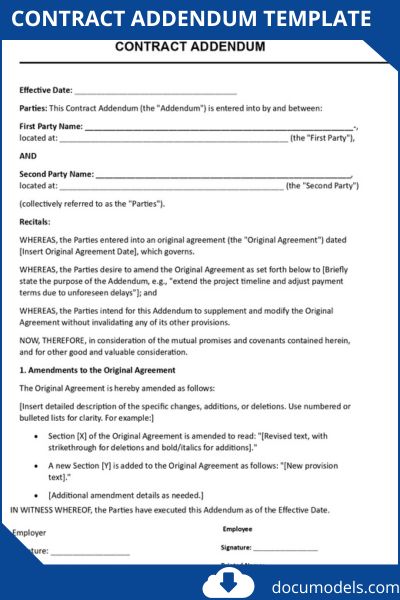

Partnership Agreement TemplatePartnership Agreement Template

What Is a Partnership Agreement?

A partnership agreement is a legally binding contract between two or more business partners. It outlines the rights, responsibilities, and operational details of the business. Think of it as a comprehensive rulebook that governs the partnership.

Partnership agreements can be simple or complex, depending on the business’s size and nature. They are typically drafted before the business launches but can be created or amended later if needed.

This document details crucial aspects of the business relationship, including:

- How decisions will be made.

- The roles and contributions of each partner.

- How profits and losses will be distributed.

- The steps to take if a partner wants to leave or if the business dissolves.

Without a formal agreement, your business is subject to your state’s default partnership laws. These generic rules may not align with your specific intentions or the unique needs of your business, which can lead to disputes and legal complications down the road.

Who Needs a Partnership Agreement?

Any business venture involving two or more co-owners should have a partnership agreement. While you might feel that a verbal agreement is enough, especially when working with friends or family, a written document is essential for clarity and legal protection.

You should create a partnership agreement if you are:

- Starting a new business with a co-founder. This is the most common and critical scenario.

- Bringing a new partner into an existing sole proprietorship. An agreement formalizes the new structure and expectations.

- Operating a business informally with a partner. Even if your business is small, a formal agreement prevents misunderstandings.

- Engaging in a joint venture for a specific project. A temporary partnership agreement can define the scope and terms of the collaboration.

What Should I Include in a Partnership Agreement?

A well-crafted partnership agreement should be comprehensive yet straightforward. It acts as a roadmap for your business operations.

Below is a detailed list of essential elements to include, based on common best practices:

- Partnership Name and Business Details: Specify the official name of the partnership, its primary location, and the nature of the business. This sets the foundation and helps with legal filings.

- Partner Contributions and Ownership Percentages: Detail what each partner is bringing to the table—cash, property, intellectual property, or services—and how ownership is divided (e.g., 50/50 or based on contributions).

- Profit and Loss Distribution: Outline how profits and losses will be shared. This could be equal, proportional to ownership, or another agreed-upon method. Also, address how and when distributions occur.

- Decision-Making and Authority: Define how decisions are made (e.g., majority vote, unanimous consent for major issues). Specify each partner’s authority to bind the partnership in contracts or loans.

- Roles and Responsibilities: Assign specific duties to each partner, such as who handles day-to-day operations, finances, or marketing. This prevents overlap and ensures accountability.

- Duration of the Partnership: State whether the partnership is for a fixed term or indefinite. Include conditions for extension or early termination.

- Buyout and Exit Provisions: Cover what happens if a partner wants to leave, retires, or passes away. Include buy-sell agreements, valuation methods, and non-compete clauses.

- Dispute Resolution: Specify how conflicts will be handled, such as through mediation, arbitration, or court. This can save time and money.

- Amendments and Governing Law: Explain how the agreement can be changed (usually requiring written consent) and which state’s laws apply.

Simple table summarizing key inclusions:

| Section | Purpose | Example |

| Contributions | Defines initial investments | Partner A: $50,000 cash; Partner B: Equipment worth $30,000 |

| Profit Sharing | Allocates earnings | 60% to Partner A, 40% to Partner B |

| Decision-Making | Outlines voting rights | Unanimous for major decisions; Majority for routine |

| Exit Strategy | Handles departures | Buyout at fair market value minus debts |

Types of Partnership Agreements

Partnership agreements vary based on the level of liability, control, and structure desired. Understanding the types helps you choose the right one for your business.

Here are the most common types:

- General Partnership (GP): All partners share equal responsibility for management, profits, and liabilities. It’s the simplest form but offers no personal liability protection—partners are personally liable for debts.

- Limited Partnership (LP): Includes general partners (who manage and are fully liable) and limited partners (who invest but have limited liability and no management role). Ideal for attracting investors without giving them control.

- Limited Liability Partnership (LLP): All partners have limited liability, protecting personal assets from business debts or partner misconduct. Common in professional services like law or accounting firms.

- Limited Liability Limited Partnership (LLLP): A hybrid of LP and LLP, offering limited liability to all partners, including general ones. Available in some states and suits high-risk ventures.

For a quick comparison, see the table below:

| Type | Liability Protection | Management Involvement | Best For |

| General Partnership (GP) | None (personal liability) | All partners | Small, equal-control businesses |

| Limited Partnership (LP) | Limited for silent partners | General partners only | Investor-funded ventures |

| Limited Liability Partnership (LLP) | Limited for all | All partners | Professional services |

| Limited Liability Limited Partnership (LLLP) | Limited for all | General partners | Complex, high-risk setups |

How to Write a Partnership Agreement

Writing a partnership agreement doesn’t have to be overwhelming. Follow these step-by-step instructions to create a solid document:

- Research Legal Requirements: Check your state’s laws on partnerships (e.g., via the Secretary of State’s website). Some require filing, while others don’t. Understand default rules to override them if needed.

- Gather Partner Input: Discuss key terms with all partners. Use meetings to align on contributions, roles, and goals. This ensures buy-in and reduces future disputes.

- Outline the Structure: Start with basic info like the partnership name, start date, and type (GP, LP, etc.). Define the business purpose clearly.

- Detail Financial Aspects: Specify contributions, ownership percentages, profit/loss sharing, and accounting methods. Include how taxes will be handled (partnerships are pass-through entities).

- Address Operations and Governance: Cover daily management, decision-making processes, and partner duties. Include provisions for meetings and voting.

- Plan for Changes and Endings: Include clauses for adding/removing partners, dissolution, and asset distribution. Add non-disclosure and non-compete agreements if relevant.

- Use Clear Language and Review: Write in simple, unambiguous terms. Avoid jargon unless necessary. Have a lawyer review it for legality and completeness.

- Sign and Notarize: All partners should sign. Notarization adds enforceability. Store copies securely and revisit annually.

Format model to edit

Related Articles: