Securing the right space for your business is a pivotal step toward achieving your goals, but it brings with it a significant responsibility—signing a commercial lease agreement.

This document is more than just a formality; it’s a legally binding contract that defines the relationship between landlords and tenants, covering essential details like rent, lease length, and the rights and obligations of each party. For many businesses, it sets the framework for daily operations and long-term stability.

Understanding your commercial lease agreement is crucial to avoiding unnecessary risks or disputes. Beyond the basics, it can include clauses on property maintenance, usage limitations, options for renewal, and even conflict resolution processes.

In this article, we will delve into the complexities of commercial lease agreements, providing you with a comprehensive guide to understanding and effectively negotiating them. Additionally, we will provide contract examples to further clarify these concepts, helping you to avoid common mistakes.

Table of Contents

- 1 What is a Commercial Lease Agreement?

- 2 Common Types of Commercial Properties

- 3 Types of Commercial Leases

- 4 What Should Be Included in a Commercial Lease Agreement?

- 4.1 1. The Basics

- 4.2 2. Rent Terms

- 4.3 3. Security Deposit

- 4.4 4. Permitted Use of the Property

- 4.5 5. Property Maintenance and Repairs

- 4.6 6. Alterations and Improvements

- 4.7 7. Exit and Termination Clauses

- 4.8 8. Liabilities and Insurance Requirements

- 4.9 9. Subleasing or Assignment

- 4.10 10. Dispute Resolution

- 4.11 11. Other Clauses to Look For

- 5 Commercial Lease Agreement Template

- 6 Key Tips When Signing a Commercial Lease Agreement

What is a Commercial Lease Agreement?

A commercial lease agreement is a legally binding contract between a landlord and a tenant that allows the tenant to use a commercial property for business purposes in exchange for regular rent payments.

Unlike residential leases, these agreements are specifically designed to address the unique needs of businesses and come with more complex terms and conditions.

Key Features of a Commercial Lease Agreement

- Purpose: Specifies that the property is used solely for business, not residential, activities.

- Duration: Can be short-term (e.g., 1–3 years) or long-term (e.g., 5–10 years), often with options to renew.

- Flexibility: Terms may be negotiated to suit both parties, involving rent price, property maintenance, and lease length.

- Legal Protection: Clearly outlines responsibilities, limits, and rights. It ensures both parties know their obligations.

Common Types of Commercial Properties

- Office Spaces

- Examples include business hubs, co-working spaces, and corporate buildings.

- These are ideal for companies needing administrative or client-meeting spaces.

- Retail Stores

- Includes shopping malls, standalone shops, and storefronts.

- Perfect for businesses selling products or offering services directly to customers.

- Warehouse and Industrial Spaces

- Used for storage, manufacturing, distribution, or logistics centers.

- Examples include factories and large industrial units.

- Hospitality Properties

- Hotels, restaurants, and cafes all fall under this category.

- Special-Use Properties

- Examples include healthcare facilities, gyms, schools, and entertainment venues.

Types of Commercial Leases

When negotiating a commercial lease, it’s important to know what type of lease you’re entering into. Different types of leases distribute costs in various ways, which can significantly affect your long-term expenses.

Below are the most common types of commercial leases:

1. Gross Lease (Full-Service Lease)

Under a gross lease, the tenant pays a fixed rent amount, and the landlord covers operating expenses like property taxes, insurance, and maintenance. This is often considered the most straightforward option for tenants, as additional costs are minimal.

Example: You rent an office for $3,000/month, and the landlord covers utilities, cleaning services, and building repairs.

- Best For: Small businesses or companies looking for predictable expenses.

2. Net Lease

With a net lease, the tenant pays rent plus a portion of the property’s operating expenses. There are different types within this category:

Single Net Lease (N Lease)

- Tenant pays rent and property taxes.

- Landlord covers insurance and maintenance costs.

Double Net Lease (NN Lease)

- Tenant pays rent, property taxes, and insurance.

- Landlord handles property maintenance.

Triple Net Lease (NNN Lease)

- Tenant is responsible for rent, property taxes, insurance, and maintenance.

- This is one of the most common commercial leases.

Example: You lease a retail space for $2,500/month and also pay $500/month in taxes and $300/month for insurance.

- Best For: Tenants who want more control over operational costs and landlords seeking fewer expenses.

3. Percentage Lease

A percentage lease requires the tenant to pay base rent plus a percentage of their business’s gross income. This type of lease is common in retail spaces, where business revenues fluctuate.

Example: A retail shop pays $1,000/month in base rent, plus 5% of its monthly sales exceeding $10,000.

- Best For: Businesses operating in high-traffic areas, such as malls.

4. Modified Gross Lease

A modified gross lease is a middle ground between gross and net leases. The tenant and landlord split operating costs, but details vary by agreement.

Example: The landlord agrees to pay for property management, while the tenant handles utilities and cleaning.

- Best For: Companies seeking a balance between control over expenses and simplicity in payments.

5. Ground Lease

Under a ground lease, tenants lease the land but build and own the structures they place on it. This type is often long-term, lasting decades.

Example: A fast-food chain builds a restaurant on leased land, retaining ownership of the building.

- Best For: Businesses that want to establish permanent infrastructure without purchasing property.

What Should Be Included in a Commercial Lease Agreement?

When drafting or reviewing a commercial lease agreement, it’s essential that it contains clear, detailed, and complete information.

Below is a rundown of the key components every agreement should include:

1. The Basics

Every lease agreement starts with general information. Ensure it specifies:

- Landlord and tenant details (names and contact info).

- Address of the leased property.

- Lease term (start date and end date or if it’s a month-to-month lease).

2. Rent Terms

This is one of the most important sections. It should detail:

- Rent amount (monthly or annual).

- Payment due dates.

- Accepted payment methods.

- Provisions for rent increases during the lease, if any.

- Penalties for late payments.

3. Security Deposit

The lease must specify the:

- Amount of the security deposit.

- Conditions under which it will be refunded or retained.

- Timeline for returning the deposit after lease termination.

4. Permitted Use of the Property

This clause outlines what the tenant can and cannot do in the leased space.

It could include:

- The nature of the business allowed (e.g., retail, office, manufacturing).

- Any restrictions on operations (e.g., noise ordinances, hours of operation).

5. Property Maintenance and Repairs

The agreement should define who is responsible for maintaining the property.

Key points include:

- The tenant’s responsibility for keeping the property clean and safe.

- The landlord’s responsibility for major repairs (e.g., HVAC system, roof).

- Procedures for reporting and addressing damages.

6. Alterations and Improvements

For tenants looking to customize the space, this section is critical.

It should detail:

- Whether changes or renovations are allowed.

- Who pays for these changes.

- Whether the property must be restored to its original condition.

7. Exit and Termination Clauses

Clear language about ending the lease is crucial:

- Renewal terms if either party wants to continue the agreement.

- Conditions for early termination, including associated fees.

- Procedures for the final walkthrough and returning the property.

8. Liabilities and Insurance Requirements

The lease should clearly list each party’s liabilities and specify the type of insurance required. This often includes:

- General liability insurance.

- Property insurance for the landlord.

- Required coverage for tenant property and activities.

9. Subleasing or Assignment

Tenants may want to sublease the space or assign the lease to another party. The agreement should define whether this is allowed, and if so, under what conditions.

10. Dispute Resolution

How will disputes between the landlord and tenant be handled? Common methods include:

- Mediation.

- Arbitration.

- Legal action.

11. Other Clauses to Look For

Aside from the essentials above, be on the lookout for these additional clauses:

- Force Majeure Clause: Defines what happens if unexpected events, like natural disasters, disrupt business operations.

- Right to Entry Clause: Clarifies when and how the landlord can access the property for inspections or repairs.

- Exclusive Use Clause: Potentially guarantees the tenant that no competing business will occupy the same property.

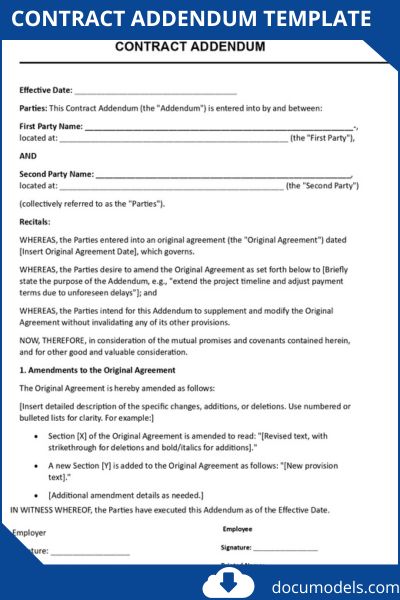

Commercial Lease Agreement Template

COMMERCIAL LEASE AGREEMENT

This Commercial Lease Agreement (“Lease”) is entered into on [Effective Date] by:

Lessor: [Lessor Name], [Lessor Address]

Lessee: [Lessee Name], [Lessee Address]

1. PREMISES

Lessor leases to Lessee approximately [Square Feet] square feet of [type of space] located at [Premises Address] (“Premises”). [Include description of the Premises, common areas, parking, etc.]

2. TERM

The lease term is [Number] years, beginning [Start Date] and ending [End Date], unless terminated sooner.

3. RENT

A. Base Rent. Lessee shall pay base rent of $[Amount] per month, due on the 1st of each month.

B. Rent Adjustments. Annual rent increases by [Percentage]%, effective [Date] each year.

C. Additional Rent. Lessee shall pay its share of operating expenses, taxes, and utilities.

D. Late Charge. Rent paid over [Days] late incurs a [Percentage]% late fee.

4. SECURITY DEPOSIT

Lessee shall pay Lessor $[Amount] as a security deposit upon lease execution.

5. USE

A. Permitted Use. The Premises shall be used solely for [Permitted Use].

B. Compliance. Lessee shall comply with all laws and shall not permit any nuisance.

6. UTILITIES & SERVICES

Lessee shall pay for all utilities and services supplied to the Premises.

7. MAINTENANCE & REPAIRS

A. Lessee Responsibilities. Lessee shall maintain the Premises in good condition.

B. Lessor Responsibilities. Lessor shall maintain the building structure and systems.

8. ALTERATIONS

Lessee shall not make alterations without Lessor’s prior written consent.

9. INSURANCE

A. Property Insurance. Lessor shall maintain full replacement property insurance.

B. Liability Insurance. Lessee shall maintain $[Amount] commercial general liability coverage.

10. CASUALTY

If the Premises are damaged by casualty, Lessor may terminate or shall repair. Rent abates during repairs to the extent the Premises are untenantable.

11. ASSIGNMENT & SUBLETTING

Lessee may not assign this Lease or sublet without Lessor’s written consent.

12. DEFAULTS

If Lessee defaults on rent or other terms, Lessor may terminate upon [Days] days notice.

13. SURRENDER

Upon Lease expiration, Lessee shall vacate and surrender the Premises in good condition.

14. HOLDOVER

If Lessee holds over, tenancy becomes month-to-month at [Percentage]% of last rent.

15. NOTICES

Notices shall be in writing, deemed given upon personal delivery, recognized overnight courier, or [Number] days following deposit in U.S. mail.

16. SUBORDINATION

This Lease is subordinate to any mortgage or deed of trust on the property.

17. ESTOPPEL

Within [Days] days of request, Lessee shall execute an estoppel certificate.

18. ENTIRE AGREEMENT

This Lease is the entire agreement between the parties regarding the Premises.

19. SEVERABILITY

If any Lease provision is invalid, the remainder shall remain in effect.

20. GOVERNING LAW

This Lease shall be governed by [State] law.

Exhibits:

A – Premises Floor Plan

B – Lessor Work Letter

C – Lessee Work Letter

Lessor: Lessee:

____________________ ____________________

[Name], [Title] [Name], [Title]

Key Tips When Signing a Commercial Lease Agreement

- Review the Agreement with an Attorney

Commercial leases often contain complex legal language. Consult a real estate lawyer to ensure your interests are protected. - Negotiate Terms

Unlike residential leases, commercial agreements are negotiable. Discuss rent, maintenance, and exclusive-use clauses to get favorable terms. - Understand Financial Implications

Be clear on upfront costs like security deposits, monthly rent, potential increases, and any hidden fees. - Inspect the Property

Before signing, thoroughly inspect the space and ensure it meets the needs of your business operations.

Format model to edit

Related Articles: